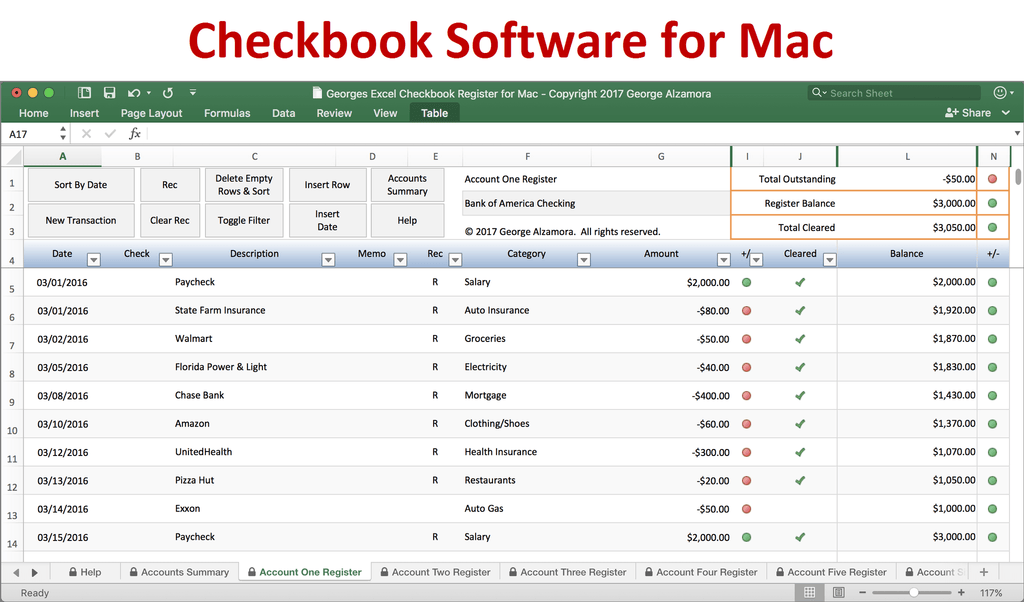

This is one of the most crucial areas of the check register. If you have two accounts and need to transfer money from one to the other for any reason, you must enter the amount in the check register. This is the money you’ve put into your checking account. You must ensure that the fee amount is written in this check register field. This is the amount that has nothing to do with the bank or the transaction. For example, if you withdraw money from an ATM, you will be charged additional fees called service costs. This is a list of any fees that may have been charged during the transaction. You must guarantee that you type the entire and accurate amount. This is the amount of money you drew from the bank for whatever reason. Whether you paid with a debit card, a credit card, or through internet banking, you must verify that the precise amount of the payment is entered in this box. In the section, you must include the precise payment. This is the amount of money written on the check. For example, if you are working with a store for your company, include their name in the description. In general, start the transaction description with the person’s name. This is the description that determines who receives the check. You must ensure that you write the exact date, as the individual for whom you are writing may not get the cash in their bank deposit if you make a mistake. Today is the day when you write the check. You can simply write the check number and ensure that no checks are missing. This is why, even if you make a mistake or an error, there is no harm. Checks are typically arranged in chronological order. It is also on the bottom of several checks. This is the number printed on the right side of the check. Check the common titles found on a check register. Almost every check register is the same and contains titles that are identical. When you write a check, you must enter it into the check register. What is a Check Register?Ĭolumns in a cash disbursements log let you organize and categorize transaction information. So, what exactly is a check register? Read on to discover more about a check register and the best check register app for your small business. A check register can provide you with an up-to-date snapshot of your transactions. However, your company bank statement may not always be up to date with the most recent information. How do you reconcile your check register with your bank statement?Īs a small business owner, you understand the importance of keeping track of your company’s finances.Can you find check register templates online?.How do you make sure your check register stays organized?.

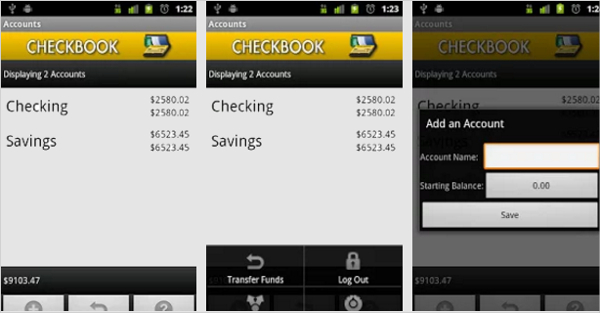

Best checkbook app 2018 android#

Which is the Best Android Check Register App?.Budget Planner With Sync – My Budget Organizer Mint: Budget, bills, and finance tracker.

0 kommentar(er)

0 kommentar(er)